There is no such entity as ‘the’ global economy in the sense of a seamless economy with clear hierarchies. The reality consists of a vast number of highly particular global circuits: some are specialised and some are worldwide while others are regional. Different circuits contain different groups of countries and cities. For instance, Mumbai is today part of a global circuit for real-estate development that includes firms from cities as diverse as London and Bogotá.

Global commodity trading in coffee includes New York and São Paulo as major hubs. Buenos Aires is on a global commodity trading circuit that includes Chicago and Mumbai. Globally traded commodities – gold, butter, coffee, oil, sunflower seeds – are redistributed to a vast number of destinations, no matter how few the points of origin are in some cases. And the current collapse of major financial institutions involves particular sets of global circuits and hence does not affect all global cities in the same way.

Not only global economic forces feed this proliferation of circuits. Migration, cultural work, and civil society’s struggle to preserve human rights, the environment, and social justice, also feed the formation and development of global circuits. Thus NGOs fighting for the protection of the rainforest function in circuits that include Brazil and Indonesia, the global media centres of New York and London, and the places where the major forestry companies and the main buyers of wood are headquartered, cities as diverse as Oslo, London and Tokyo. The other side of all these trends is an increasing urbanising of global networks.

Adopting the perspective of one of these cities reveals the diversity and specificity of its location on some, or many, of these circuits. These emergent inter-city geographies begin to function as an infrastructure for multiple forms of globalisation. The first step is to identify the specific global circuits on which a city is located. These will vary from city to city, depending on a city’s particular strengths, just as the groupings of cities vary on each circuit. All of this also shows us that the specialised differences of cities matter, and that there is less competition among cities and more of a global or regional division of functions than is commonly recognised.

For example, the knowledge economies of São Paulo, Chicago and Shanghai all share a long history of servicing major heavy manufacturing sectors. Theirs are economic histories that global cities such as New York and London never developed. Out of these specialised differences comes a global division of functions. Thus a steel factory, a mining firm, or a machine manufacturer that wants to go global will go to São Paulo, Shanghai or Chicago for its legal, accounting, financial, insurance, economic forecasting, and other such specialised services. It will not go to New York or London for this highly particular servicing.

Recognising the value of the specialised differences of cities and urban regions in today’s global economy shows how the deep economic history of a place matters for the type of knowledge economy that a city or a cityregion ends up developing. This goes against the common view that globalisation homogenises economies. How much this deep economic history matters varies, and partly depends on the particulars of a city’s or a region’s economy. It matters more than is commonly assumed, and it matters in ways that are not generally recognised. Globalisation homogenizes standards – for managing, for accounting, for building state-of-the-art office districts, and so on. But it needs diverse specialised economic capabilities.

The capabilities needed to trade, finance, service, and invest globally need to be generated. They are not simply a by-product of the power of multinational firms and telecommunications advances. The global city is a platform for producing these types of global capabilities, even when this requires large numbers of foreign firms, as is the case in cities as diverse as Beijing and Buenos Aires. Each of the 70 plus major and minor global cities in the world contributes to the production of these capabilities in its home country, and thereby functions as a bridge between its national economy and the global economy. In this networked multi-city geography, most of the 250,000 plus multinational corporations in the world have kept their headquarters in their home countries, no matter the vast numbers of affiliates, subsidiaries or offshore sourcing sites they may have around the globe.

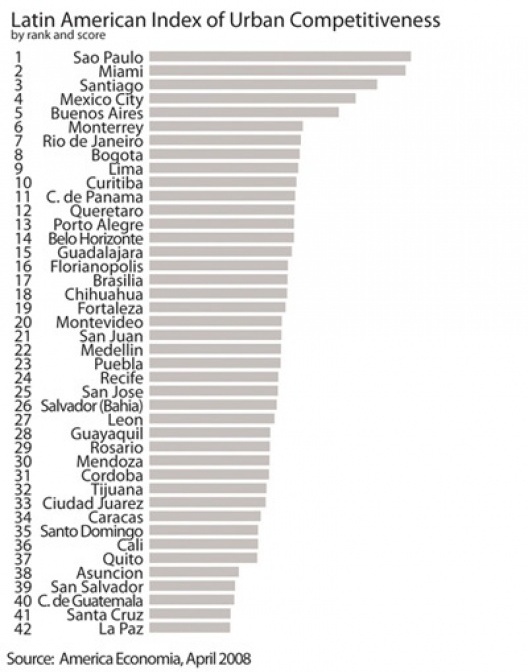

So have Latin American multinationals with expanding global regional and global operations. Brazil’s over 1,200 multinational firms, the single highest concentration in the region, have basically kept their headquarters at home, with a strong concentration in São Paulo. Within a vast and diverse region such as Latin America it has now become clear that several cities function as key hubs, each representing a distinctive mix of strengths. In a top tier we find São Paulo, Mexico City and Santiago, and in a second tier Buenos Aires, Bogotá, Caracas, Montevideo, Monterrey, Quito and Lima. Finally, there is a global Latin American space economy that includes cities outside the geographic region: Miami and Madrid are prominent in this space. For instance, the 20 major banks headquartered in Central America have about 200 correspondent links with Miami, compared to 35 with New York. In a comprehensive survey asking businesses in Latin America what is the best city to do business in Latin America, America Economia found that Miami appeared regularly in the answers.

The other side of this dynamic is that for a firm to go global it has to put down its feet in multiple cities that function as entry points into national economies. This bridging capacity is critical: the multiple circuits connecting major and minor global cities are the live infrastructure of the global economy. It indicates that cities do not simply compete with each other. A global firm does not want one global city, even if it is the best in the world. Different groups of cities will be desirable, even if they have some serious negatives. This helps explain why there is no one ‘perfect’ global city. Today’s global phase does not function through one imperial global capital that has it all.

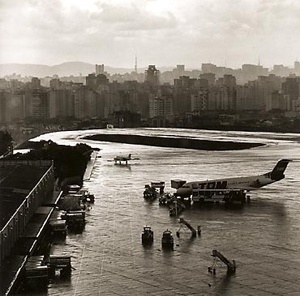

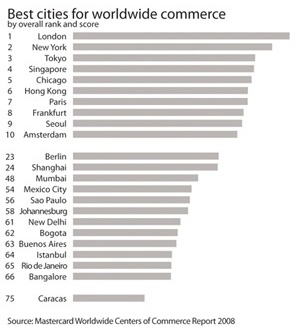

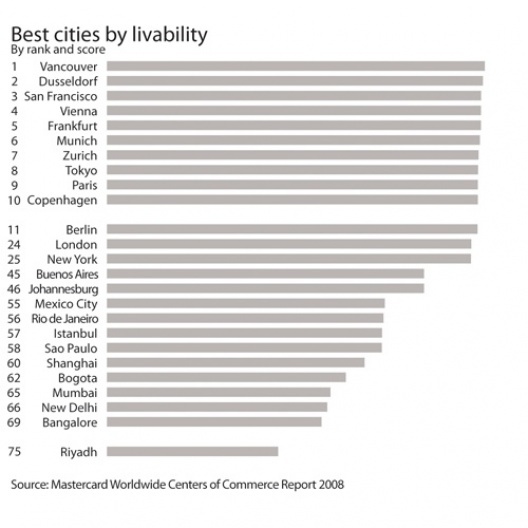

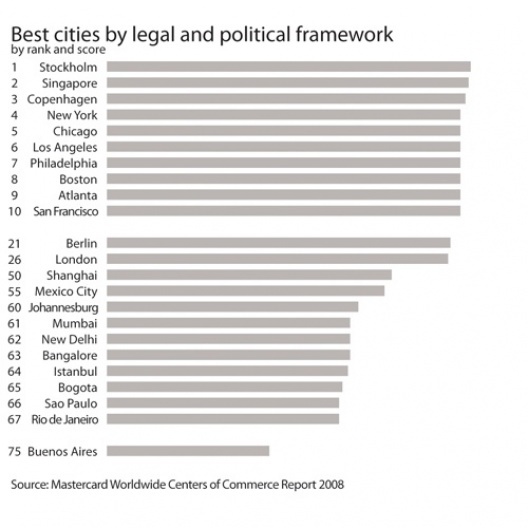

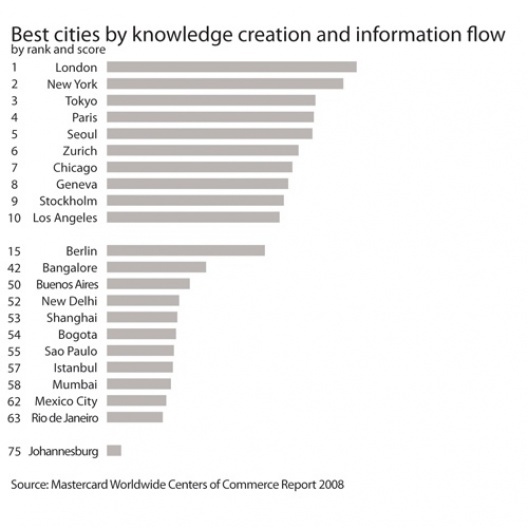

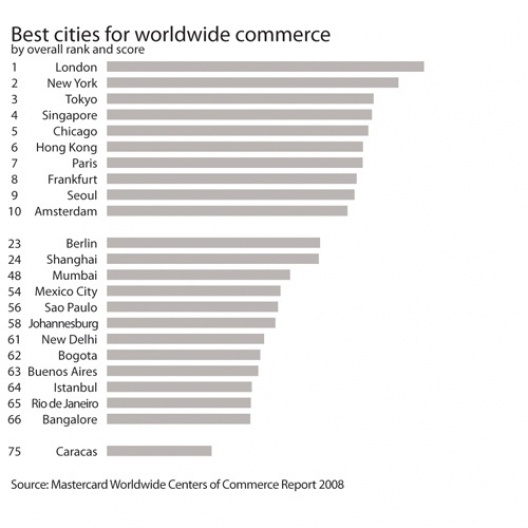

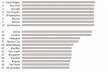

A large study of 75 cities rates the top cities for worldwide commerce. Not one of them ranks at the top in all of the 100 factors, and not one gets the perfect score of 100. London and New York, the two leading global cities, rank low in several aspects – neither is in the top ten when it comes to starting a business, or closing a business. If we consider a critical variable in the ‘ease of doing business’ indicator, part of which is ‘ease of entry and exit’, London ranks 43rd and New York ranks 56th. Perhaps most surprising, London ranks 37th on ‘contract enforcement’ and 21st on ‘investor. rotection’.

It is Singapore that ranks number one in relation to all three variables. Less surprising is that New York ranks 34th on one of the data points for ‘livability’: health and safety. In the global South, cities like Mumbai and São Paulo are in the top group for financial and economic services, but are brought down in their overall score by their low rankings in factors related to the ease of doing business and livability, given their especially low levels of well-being for vast sectors of the population. Overall, São Paulo is in a middle-ranked group of about 20 cities framed at the top by Dubai and at the bottom by Shenzhen.

The group includes some of the most powerful in the world. Furthermore, it is a power based on multiple and various conditions: cities as diverse as Beijing, Mumbai, Tel Aviv, Moscow, Johannesburg and Kuala Lumpur. This group ranks between Dubai’s 44th place with an overall score of 47, and Shenzhen’s 60th place with an overall score of 40. The scores for the top two cities are 79 for London and 72 for New York; further down, Amsterdam’s score is 60 followed by Madrid at 59, respectively the 10th and 11th ranked global cities in the world for commerce.

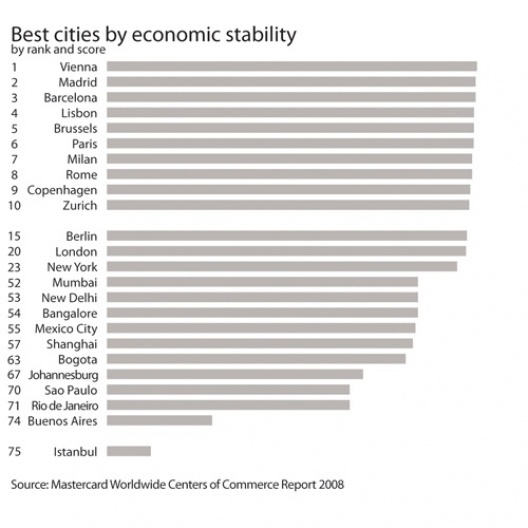

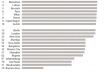

Some of São Paulo’s lowest rankings are in macro-economic variables, such as ‘political and legal framework’ and ‘economic stability’. Cities at similar levels on these two indicators within South America are Bogotá, Caracas, and Buenos Aires, and, outside of South America, Johannesburg, Mumbai, Moscow, Budapest and Istanbul. Sub-indicators such as ‘dealing with licenses’ and ‘registering property’, where the city’s implementation of national regulations and laws can make a difference, point to a considerable variability in performance. São Paulo does not do better than in the basic macro-economic variables such as inflation. But Bogotá, Buenos Aires and Caracas all do much better on these two subindicators than they do on purely macro-economic variables, pointing to more successful implementation.

This negative urban performance also comes through on the indicator measuring the ‘ease of doing business’. São Paulo ranks considerably below its overall ranking in the global set of 75 cities. With Dubai it is just the inverse: on ‘ease of doing business’ it does much better than its overall ranking. When disaggregated into sub-indicators, São Paulo is below its overall rank on ‘starting a business’, ‘employing workers’, ‘closing a business’, ‘banking services’ and ‘contract enforcement’. São Paulo ranks well above its overall score on ‘investor protection’, ‘getting credit’, and ‘ease of entry and exit’ – though on this last one Caracas does even better.

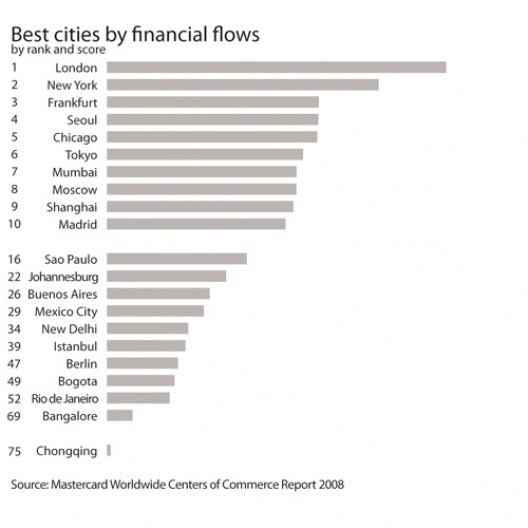

São Paulo’s ranking of 16 on the ‘financial centre’ indicator sits sharply above its overall ranking, putting it in the top echelon of the global economy; Santiago, Mexico City, Buenos Aires and Bogotá also rank much higher on the ‘financial centre’ indicator than they do overall. The sharpest differentials are for São Paulo and Buenos Aires. On some of the sub-indicators São Paulo’s rank jumps to the top ten: ‘total number of derivatives contracts’ at 7, and ‘total number of commodities contracts’ at 9. It ranks 12th globally in its ‘banking and financial services companies’, 20th in ‘investment and securities firms’, 23rd in ‘equities trading’. Its lowest score on the financial dimension is 39th on ‘insurance companies’, which is still well above its overall rank. Similarly, Buenos Aires is in the top 20 for particular financial circuits – 14th in the number of ‘commodities contracts’ and 15th in the ‘value of bond trading’.

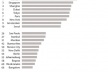

Clearly São Paulo is one of the major global financial centres in the world. Its overall score of 34.92 may not make that immediately evident. But the top-ranked financial centres are also well below the perfect score of 100: London has a score of 67.44, New York 54.60, Frankfurt 46.73, Seoul sits at 52.76, and Chicago 40.52 while Dubai is valued at 24.74, Atlanta at 8, and Edinburgh at 2. These ‘financial centre’ indicator scores are partly a function of a) the enormous weight of the major centres and b) the fact of multiple specialised types of financial circuits (equities, commodities, derivatives, bonds). This leaves even significant centres such as Dubai and Edinburgh with a very low relative score which can nonetheless override the fact that Dubai, for instance, ranks number one in ‘banking services’ along with most of the top 20 centres, except for Chicago at 41, as it has lost all its major banks, Seoul at 57 and Tokyo at 23.

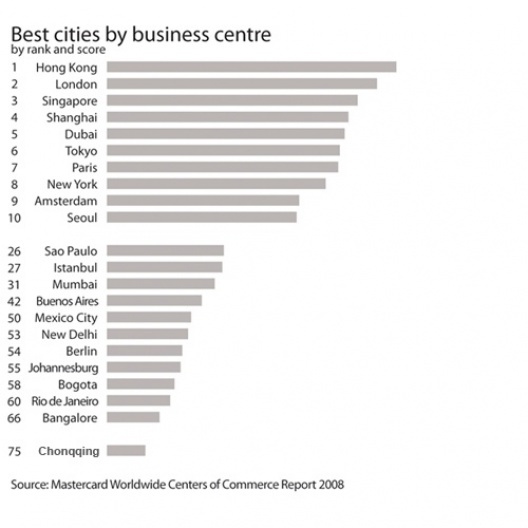

São Paulo gets its second highest indicator ranking, at 26 as a business centre. Its highest score is for ‘volume of commercial real-estate development’, placing 4th right below Shenzhen, which has seen a vast building boom. Even so, Sao Paulo’s contrasts among its sub-indicator rankings are sharp, placing 49th for international airport traffic. In this growing number of global cities and in their differences we see the larger story of a shift to a multi-polar world.

The loss of position of US cities compared with the 2006 survey is part of this shift: Los Angeles dropped from the 10th to the 17th rank, and Boston from 12th to 23rd, while European and Asian cities moved up in the top ranks, notably Madrid going from 17th to 11th. These shifts give added content to the loss of position of the United States as the dominant economic and military power. It is not that the United States is suddenly poorer, it is that other regions of the world are rising and that there are multiple forces feeding these multi-sited economic, political, and cultural strengths. The recent growth of informal economies in major global cities in North America, Western Europe, and to a lesser extent, Japan, raises a number of questions about what is and what is not part of today’s advanced urban economies.

Three trends suggest that much of today’s informalisation is actually linked to key features of advanced urban capitalism. One is the sharp emergence and growth of informal economies in the major global cities of the North. Secondly, the mostly overlooked proliferation of an informal economy of creative professionals – artists, architects, designers, software developers, event choreographers, etc. working in these cities. Finally, the new types of informalisation of work actually function as the informal equivalent of the formal deregulation in finance, telecommunications and most other advanced economic sectors pursued in the name of “flexibility and innovation”. The difference is that while formal deregulation was costly, and was paid through tax revenue as well as private capital, informalisation is low-cost and sits largely on the backs of workers and informal firms themselves.

This new creative professional informal economy greatly expands opportunities and networking potentials for these artists and professionals to operate at least partly informally. It allows them to function in the interstices of urban and organizational spaces often dominated by large corporate actors and to escape the corporatising of creative work. In this process they contribute a very specific feature of the new urban economy: its innovativeness and a certain type of frontier spirit. We can see it as a reinvention of Jane Jacobs’ urban economic creativity.

Conditions akin to those in global cities of the North may also be producing a new type of informal economy in global cities of the south, including a professional creative informal economy. Their emergence may be far less visible than in the North because they are partly submerged under the old informal economies that continue to operate in the global south, and are still more a result of poverty and survival than of the needs of advanced economic sectors.

In brief, the same politico-economic restructuring that led to the new urban economy emerging in the late 1980s also contributed to the formation of new informal economies. The decline of the manufacturing dominated industrial complex that characterized most of the twentieth century, and the rise of a new, service-dominated economic complex provide the general context within which we need to place informalisation if we are to go beyond a mere description of instances of informal work.

Thus while much has been said about the global economy homogenizing national economies, these urban facts actually point in the opposite direction: different cities have different strengths. Global firms and markets, but also cultural enterprises, want many global cities because each of these cities expands the global platform for operations, and because each is a bridge between the global and the particularities of national economies and societies. This also underlines that global cities are built, developed and made.

The rebuilding of central areas that is occurring in all of these cities, whether downtown, at the edges, or in both areas, is part of this new economic role. Rebuilding key parts of these cities as platforms for a rapidly growing range of global activities and flows, from economic to cultural and political also explains why architecture, urban design and urban planning have all become more important and visible in the last two decades. And it explains the growing competition for space in these cities and the emergence of a new type of politics, one centred in the right to the city.

Whether all of this is good or bad for the larger social fabric of these cities and their countries is a complex matter, and the subject of many debates. But the fact that global firms need cities, and indeed groups of cities, should enable the political, corporate and civic leadership in those cities to negotiate for more benefits for their cities from global firms. This could lead to overall positive outcomes if the governing classes can see that these global economic functions will grow better in a context of a strong and prosperous middle class rather than the sharp inequality and polarity that exists among a growing share of households. European global cities have done better than global cities in the United States precisely for this reason.

As was evident at the Urban Age India conference, the trends in the new rising global cities of the South have seen the now familiar trends of the North: the growing numbers of the very rich and of the very poor, along with the expansion of the impoverished old middle classes. What there will be less of in these cities is the modest middle classes and the modest-profit making economic sectors that once were the major presence in these cities: they are critical to the urban economy because they have incomes which are most likely to be fully spent in the city’s economy. Their presence is a built-in resistance to the spatial and social reshaping of cities along extreme class lines. Finally, my most pessimistic scenario is that conflict is now wired into urban space itself, partly due to gentrification and displacement and the resulting politics for space.

In some cities, for instance New York and Los Angeles, it takes the form of a diffuse petty criminality and mostly violence of the disadvantaged on the disadvantaged. In other cities, the European ones but also the rising Shanghais, it takes the form of new racisms that can lead to physical violence. And yet in others, perhaps Sao Paulo or Rio de Janeiro, at its most extreme it takes the form of partial sporadic urban warfare, including warfare in the space of prisons.

In my view we urgently need to innovate on the front of urban governance. The old bureaucratic ways will not do. This is a whole new urban era –with its share of positive potentials and its share of miseries. In cities our governance challenges become concrete and urgent. National states can keep talking; urban leadership needs to act.

about the author

Saskia Sassen is the Lynd Professor of Sociology and Member, The Committee on Global Thought, Columbia University. Her new books are “Territory, authority, rights: from medieval to global assemblages” ( Princeton University Press 2006) and “A sociology of globalization” (W. W. Norton 2007). Other recent books are the 3rd. fully updated “Cities in a world economy” (Sage 2006), the edited “Deciphering the global” (Routledge 2007), and the co-edited “Digital formations: new architectures for global order” (Princeton University Press 2005)